How to find a suitable protection and how to avoid

Occupational disability, term life insurance, long-term care, accident........

27.01.2018

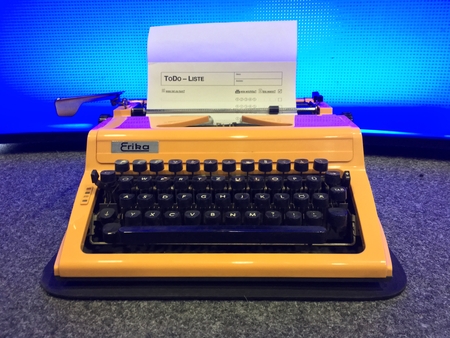

Modern times or doing everything like yesterday?

Comparison portals such as Check24 or Verifox give customers the feeling that all their financial and insurance needs can be managed from their mobile phone. However, there is a difference between feeling and insurance cover, which some people only notice in the event of a claim. Only a few weeks ago, our research team tested a very large one of these portals and found out in the automotive sector that the highly important driver protection is fundamentally lacking in motor vehicle tariffs and was not possible directly via the portal. In response to a telephone enquiry, we were informed that the client was able to clarify with the brokered company itself.

ARD, first german Television, tested one of these comparison portals and found out that only the contributions were stated for occupational disability insurance. At a time when a single insurer is raising premiums for its risk life + occupational disability insurance by up to 40%, it is very exciting. In response to a request, the platform replied that the customer can calculate the actual contributions in the portal with the help of three-set calculations. Very exciting, but which young customer is watching such shows on ARD in the evening?

Nevertheless, it has meanwhile been accepted by the customer that there are a number of insurance companies in Germany and that prices and conditions vary by up to several hundred percent.

We are for digital and personal. Customers are just beginning to see the difference between insurance brokers and agents. A few months ago, we were able to win a very important insurance industry expert as a customer. Among others, he is a specialist lawyer in this field. He approached us directly and clearly justified his decision to choose an insurance broker with his options: The large selection of companies, the possibilities in terms of prices, risk, conditions, stable healthy societies to choose and flexibility. The most important thing for him, however, was the possibility of an anonymous preliminary inquiry with many companies at the same time, which exclusive representatives are not able to do.

We value representatives very much, one of them has just become a partner with us. Many of us were exclusive agents ourselves. However, if you want to survive on the market in the future, you have to look at your business model from the customer's point of view. At the latest when you explain the possibilities to the customer, there is no going back. We ourselves have chosen a mix of digital and stores, we believe that in the case of performance you will appreciate both.

#GELDPILOT24 #SIMPLIFYyourfinances

#makeabetterworld #moderntimes #versicherungsvertreter #versicherunsgvergleich

Back to list